SaaS unit economics tell you whether the business grows in a healthy way or simply grows in size. Revenue can increase while profitability weakens, and signups can rise while the cost to acquire each customer increases quietly in the background. When you understand unit economics, you see beyond surface-level growth and into the real financial engine of the product. This becomes even more important as customer profitability trends shift across segments and markets.

Many teams look at unit economics only during fundraising or annual planning. In reality, they shape daily decisions. Pricing, product strategy, onboarding, and support all influence whether customers become profitable, how long they stay, and how much value the business earns from each relationship. Strong unit economics come from understanding how customers behave, not from spreadsheets alone.

Why SaaS Unit Economics Matter More Than Ever

Healthy unit economics make the entire business more predictable. When you know the true cost of acquiring and retaining a customer, you understand what type of growth is sustainable. This helps avoid scaling problems where acquisition costs rise faster than revenue. Strong economics also protect the business during market shifts. When budgets tighten or competition increases, companies with stable profitability have more room to adapt.

Unit economics also improve strategic clarity. When you know which customer segments produce the strongest long-term results, you can invest in the right audiences instead of chasing noisy top-of-funnel growth. Acquisition becomes more efficient. Onboarding becomes more focused. Support becomes more intentional. The business begins moving in one direction rather than many.

Customer profitability trends bring this picture into focus. They show which parts of the business are gaining traction and which parts drain resources. Trends help teams understand whether customers become more profitable over time or whether profitability erodes as usage increases. This is why a clear connection between SaaS unit economics and customer profitability is essential.

How Customer Profitability Trends Shape Unit Economics

Customer profitability trends reveal the relationship between cost and value over the customer lifecycle. As customers adopt more features, use the product more deeply, or expand their teams, profitability can grow naturally. Other times, customers generate higher support costs, require custom solutions, or adopt usage patterns that strain margins.

Profitability trends help teams see these patterns early. They surface questions such as which segments produce higher lifetime value, which plans generate the strongest margins, and which behaviors predict long-term revenue. When viewed consistently, these trends show how different groups move through the product and how much they contribute to sustainable growth.

They also reveal whether the business relies on a small group of highly profitable customers or maintains balanced profitability across segments. Companies with a narrow base of profitable accounts face greater risk. Companies with broad profitability are more resilient. Understanding these patterns allows teams to shape pricing, packaging, and product strategy with confidence.

How High-Growth SaaS Companies Use Unit Economics to Guide Strategy

Different companies approach unit economics in different ways, but the strongest strategies come from those that let customer behavior influence financial decisions.

Shopify focuses heavily on long-term value. Their profitability improves as merchants grow, adopt more tools, and build deeper operations on the platform. This creates a natural alignment between product success and customer revenue, which stabilizes overall unit economics.

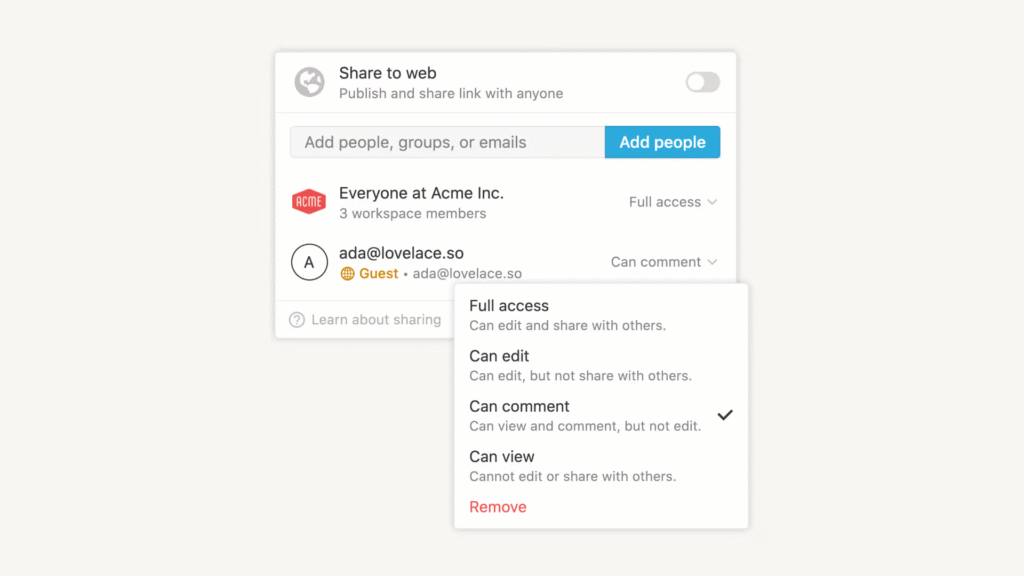

Notion shapes its economics around collaborative expansion. Profitability strengthens as teams grow, add more members, and integrate Notion into broader workflows. This creates a predictable model where deeper usage leads to stronger economics.

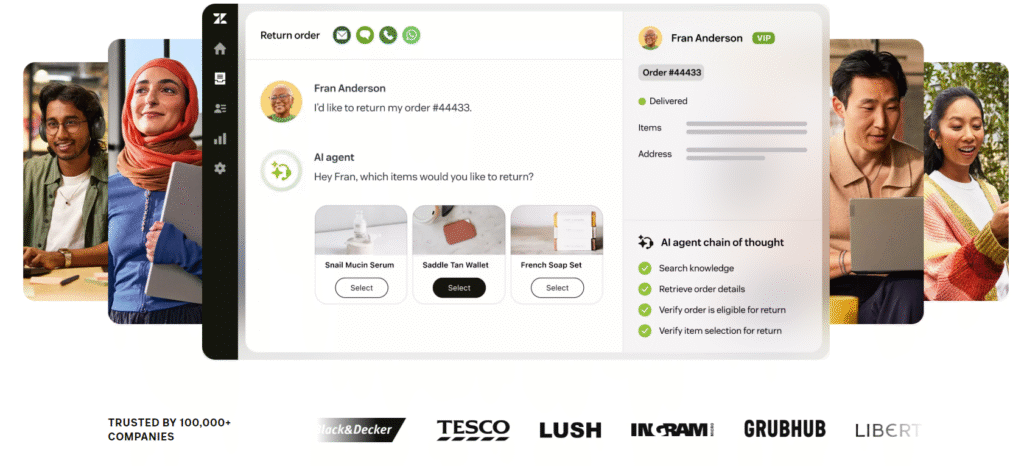

Zendesk pays attention to support intensity. They track how different customer types use the platform and how much support they require. This helps them design pricing that aligns with usage while maintaining healthy margins across different segments.

Each company uses customer profitability to guide their approach. They track how value grows, where costs increase, and how these patterns affect overall economics. Their strategies evolve as customer behavior evolves.

What These Examples Reveal About Strong Unit Economics

Companies with strong unit economics align their financial model with customer behavior rather than forcing customers into a rigid structure. They design their pricing around value delivered, not internal assumptions. They invest in segments that show consistent profitability and adjust or sunset segments that consistently drain resources.

They also recognize that unit economics improve when onboarding and adoption improve. When customers activate faster, learn the product more effectively, and reach outcomes sooner, their lifetime value increases naturally. Good activation reduces churn. Good retention increases profitability. The financial model benefits when the product experience is strong.

Another pattern is that strong companies use profitability to guide product priorities. They invest more heavily in features that contribute to long-term value and reduce investment in areas that create usage but not revenue. This creates a cycle where product improvements reinforce financial stability.

Practical Ways to Improve Your SaaS Unit Economics

Improving unit economics begins with understanding which customers create lasting profitability. This requires tracking profit contributions over time rather than relying on assumptions. You can then shape your pricing and product strategy around the segments that produce the healthiest results.

Start by analyzing activation and adoption patterns. Customers who reach value quickly almost always become more profitable. Improving onboarding increases lifetime value without increasing acquisition costs.

Next, evaluate your pricing boundaries. If customers consistently adopt features that cost more to support than they generate in revenue, you may need to adjust your packaging or limits. Pricing should reflect the real cost of delivering value.

Then identify segments that generate consistent profitability. These segments guide acquisition priorities. When you attract more customers who align with strong profitability patterns, your unit economics improve naturally.

Finally, monitor support intensity. High support costs can weaken margins even when revenue is strong. Streamlining workflows, improving documentation, and refining product design all help maintain healthy economics.

Final Thoughts

SaaS unit economics become much clearer when viewed through the lens of customer profitability. When customer behavior aligns with the financial model, growth becomes sustainable, predictable, and stable. Understanding these trends helps teams focus on the customers who create long-term value and make decisions that strengthen the business. When product experience, pricing, and profitability reinforce each other, the foundation of the business becomes far more resilient.